Original article (in Serbian) was published on 3/9/2025; Author: Teodora Koledin

During an appearance on Happy TV’s show “After Lunch”, businessman Vladimir Đukanov spoke about how much Serbian citizens borrow from banks. On that occasion, he stated the following:

“Serbia is one of the least indebted countries in Europe. At the end of 2024, citizens owed 13.3 billion euros; when divided, that comes to about 2,000 euros per person. That is a negligible debt. In percentage terms, that’s about 19% of our GDP. The European average is about 46%, which means that, by this criterion, we are significantly below the European average.”

Here, Đukanov is not referring to public debt, but to household debt in Serbia. Shortly afterward, this excerpt from the show was shared on the Telegram channel Eastern Future, accompanied by the claim that “Serbia is the least indebted country in Europe!” While it is true that Serbian households are below the European average by this measure, it is incorrect to say they are the “least indebted” or that Serbia is “the least indebted country in Europe.”

Aleksandar Milošević, editor of the Nova ekonomija portal, told Tragač that this debt “in no way represents a parameter that shows Serbia’s overall indebtedness.”

On household debt to banks

First of all, it is important to stress that household debt to banks is not the same as a country’s public debt. Our interlocutor explains that the indebtedness of a country “usually refers to public debt – that is, the debt of the state and local governments, plus guarantees for public companies. But total indebtedness also includes private debt (corporate borrowing), as well as household debt.”

On the other hand, household debt to banks refers “exclusively to debt from loans, credit cards, overdrafts, etc., incurred by citizens themselves.”

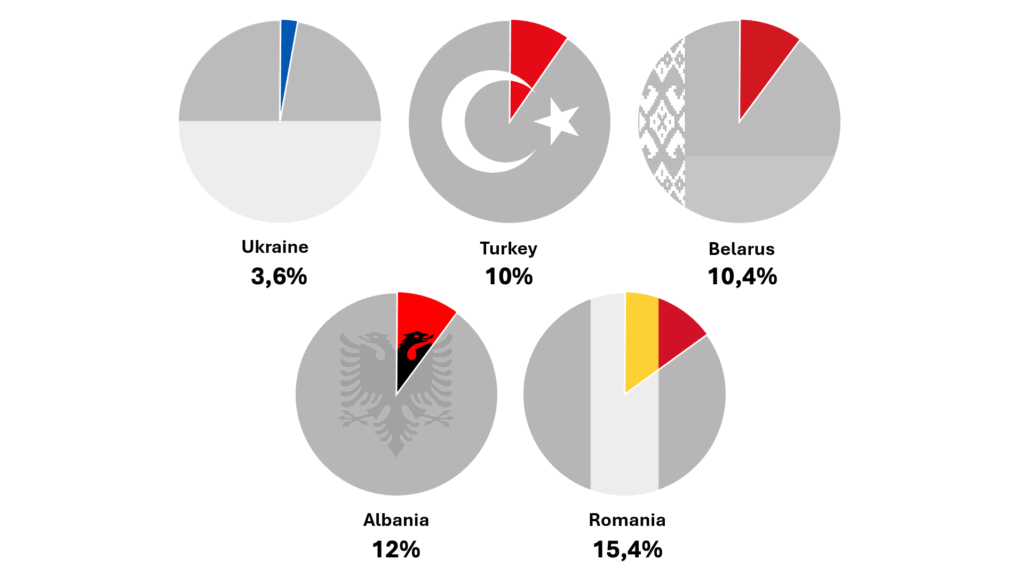

If we look solely at this criterion, according to data from the international database CEIC Data, these European countries rank below Serbia, with lower household debt-to-GDP ratios:

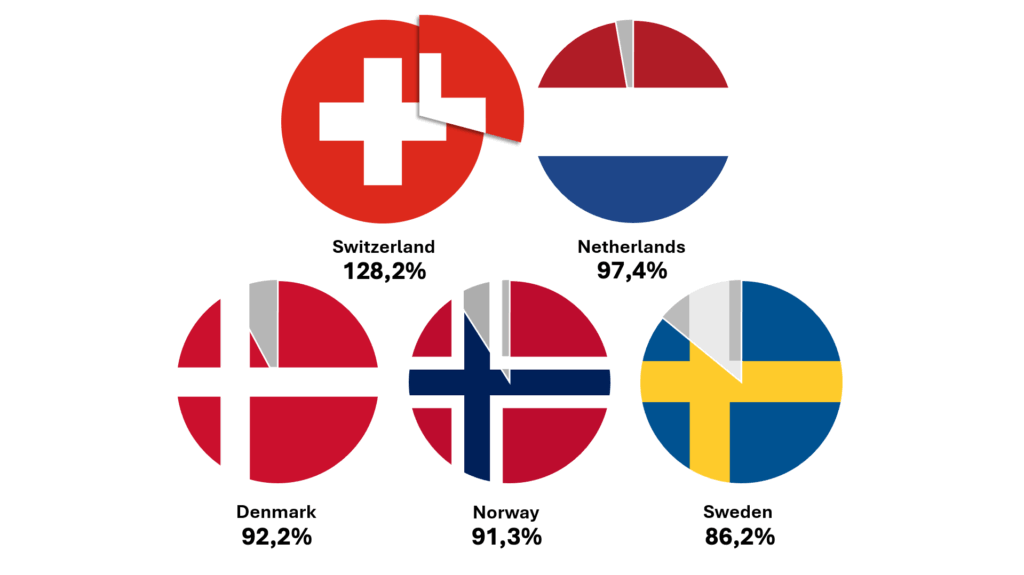

By contrast, the countries with the highest levels of household debt in Europe are:

Although at first glance the fact that Serbians are among the “least indebted” peoples in Europe may sound positive and praiseworthy, this is not necessarily a good sign for an economy, Milošević explains:

“A lower share of household debt relative to GDP compared to other countries should not automatically be seen as a positive indicator of our economy and living standards. Quite the opposite – it often reflects a generally low standard of living and low disposable income, which prevent citizens from taking on larger loans. Put differently, after paying utility bills, rent, food, and other basic needs, Serbian citizens are left with very little money, so they cannot even consider larger loans – for a new car or an apartment, for example. That’s why our relative indebtedness is lower than in developed countries. In addition, banks in Serbia are quite conservative in approving new loans, charging high interest and fees – partly due to the risks of doing business here – all of which limits borrowing.”

The fact that countries with higher living standards top the list for household debt is, according to Milošević, “very logical” since in those countries “people are left with more disposable income they can freely spend, without the fear that loan installments will prevent them from covering their regular living expenses.”

Even if we were to consider public debt, Serbia would still not be the least indebted country in Europe. At the end of last year, Serbia’s public debt stood at 47.4% of GDP. In the same period, many European countries had lower levels of public debt. Among them are Russia, Estonia, Bulgaria, Bosnia and Herzegovina, and others.

Old-new manipulations by the President about public debt

President of Serbia Aleksandar Vučić has repeatedly emphasized in recent appearances that at the time he became Prime Minister, public debt amounted to 79%. However, this information is false. The fact-checking portal Istinomer addressed this issue eight years ago, when Vučić claimed that in April 2014, public debt stood at 77%. This time, the figure he cites is even higher (79%).

Let’s go back about a decade. After the elections in March 2014, when the Serbian Progressive Party won, Aleksandar Vučić became Prime Minister on April 27. On the official website of the Public Debt Administration, all previously published monthly reports are available – including the one from April 2014. That report clearly shows that Serbia’s total public debt at the time was 62.7% of GDP. By the end of the same year (December), public debt had risen to 70.9% of GDP. By the end of the following year (2015), it had increased further to 75.5%.

President Vučić is not the only one spreading this misinformation; other figures close to the ruling regime do as well. For instance, Aleksa Grubešić from the Center for Social Stability stated in a recent interview on Tanjug TV that public debt was “about 80 percent, some 70-something percent” of GDP when Vučić “took over the government.”